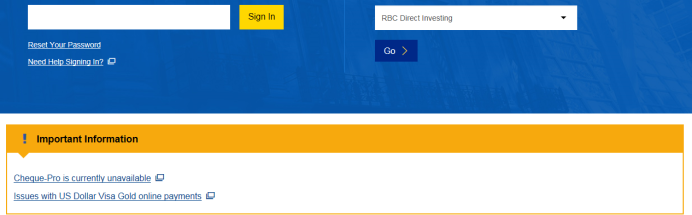

Literally 1 day after my post Cheque-Pro was up for about 2 days until they did a further shut down for maintenance. Since then every thing is back to normal. No communication other than, Royal Bank would waive the January and February fees associated with the product.

Also, amid several complaints including mine about how the new on-line banking screen had too much wasted space and was more time consuming than the original version (which was fine), they compressed the layout and made it fit on the screen. Handy when you don’t have to scroll to see all your accounts (like the original).

At least Royal finally listened. Some companies do not. The moral of the story is “listen to your customers, and if it works don’t try to fix it.” Businesses are here to make customers happy and make money, in that order.

Till next time

Rick